A true business must be able to create value beyond its owner’s abilities. If you have a business that isn’t profitable after paying owner-operators a market-based wage, then you do not really have a business, you have a very stressful job.

What is a market-based wage?

This is the amount of compensation you would expect to earn doing the same job at another company. Many times, this is explained as the amount your family would have to pay someone to take over your job if you were hit by a bus. A bit morbid but gets the point across.

It is important not to count distributions in this equation. Think of your wages as what you earn for doing your job while distributions as what you earn from your investment.

Why is it important to pay a market–based wage?

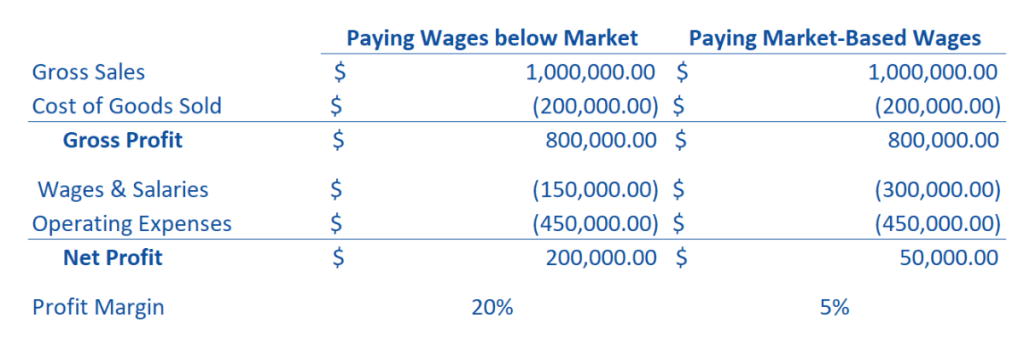

If market-based wages are not being paid, your income statement is not telling you the truth. Let’s look at this in real numbers using the table below.

The business paying below market-based wages appears like they are in excellent financial condition. But if you dig deeper into the staffing, wages are underpaid. The two partners are not taking a market-based wage for their labor contributions, and one of their spouses is working for free. It was meant to be temporary but paying out distributions became the norm when they had cash.

If we bump up wages to reflect the market worth of the employees’ contributions, as we see in the second column, the profit margin is slimmer and not actually healthy. Decisions made based on the business having a 20% profit margin can leave you with a false sense of security. If you see that your true bottom line is 5% instead of 20%, your decisions will be quite different in order to become more profitable.

If you are building to sell, a buyer must know the business can pay a market-based wage to all employees and still be profitable. If you want to grow, an investor wants to be shown how the business is properly paying the employees and ready for the next step. They do not want their cash injection to be used to level your current payroll.

Another dreaded outcome is from Uncle Sam. The IRS may flag your return as your salaries do not appear to meet their reasonable compensation tests. Then you must go through the process of somehow proving $35k is appropriate for a CEO of a million-dollar company. I have seen firsthand how this becomes an expensive failure. The fees to recalculate and file the taxes along with the penalties and interest of the late filings and payments add up quickly.

Figure your market-based salary and put it on autopilot with HR or your payroll software. This will force you to make the changes needed to cash flow your wages. If you are not able to pay out market-based wages, accrue the amount so you can see your sweat equity. This will document what is due to you when the business takes off, which is especially important if you have outside investors or partners.

How do we determine the market-based wage?

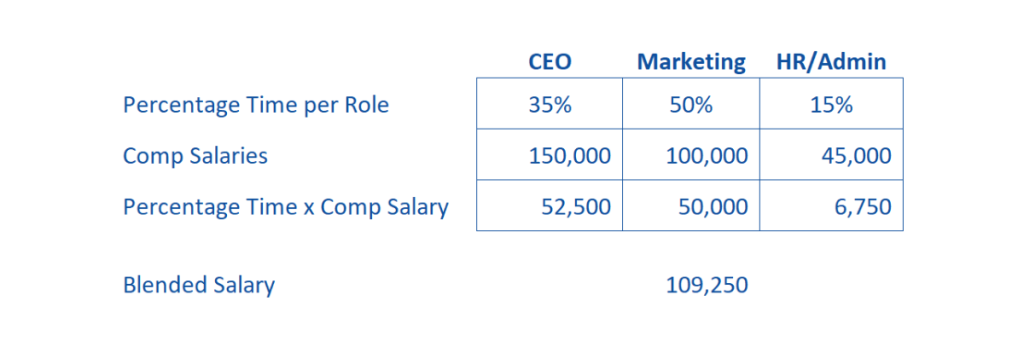

Business owners also do not always wear one hat. Break your job out to calculate a salary taking a blended approach. Look at hiring websites or labor statistics to produce a reasonable wage amount for each hat.

In this illustration, a salary of $109,250 is set as the market-based wage after considering an estimate of how the owner’s time is spent each week. Decide on a few core responsibilities to help break out into a few main categories. As needed or at least annually, adjust the percentages for your expected roles as your business grows and your hats change.

Very rarely are all owners contributing the same level of service so they should very rarely be paid the same salary. Each one should create their own blended approach to calculate their market-based salary. Let’s look at another example.

Jessica, Michael, and Patrick are 1/3 owners in Ace Marketing, LLC. Jessica manages the day-to-day operations, Michael manages the financial side of the business, and Patrick does all outside sales. Patrick’s compensation is commission based. Jessica and Michael make $75k and $65k, respectively. Each quarter they sit down and discuss the financials computed from their outside accountant and calculate distributions. These distributions are all evenly distributed since they all own a third.

There must be defined roles with market-based wages for each employee as shown with Ace Marketing. If there is not a single person designated as accountable, then no one is accountable, and things do not get done. If no one is seen as the clear leader and director, the business will stagnate very quickly because no one will have the clear responsibility to drive key decisions and initiatives. In this illustration, the owner’s all have defined areas to which they are accountable for and should be leading.

What if you cannot afford to pay yourself or others?

This indicates you have a broken business, and you must fix it. The solution could be price increases, labor productivity, or reducing operating costs.

If you cannot pay a market-based wage, this will lead to a one or all of the following outcomes:

- Burnout with no reward

- Low valuation due to no proof of concept

- No return on investment

If you are in this situation, then your priority before anything else is to become profitable.

A business starting from scratch with $0 -500k in revenue may struggle to pay a market-based wage. For example, Jennifer opens an interior design studio that generates $110k in revenue. She figures a market-based salary for herself would be $90k (10% CEO, 80% Designer, 10% Sales). Calculating all other business expenses at $35k, she is operating at a $15k loss. Jennifer’s goal should be to reach profitability before hiring an assistant or investing in other initiatives.

The Takeaway on the Market-Based Wage

In professional service industries, wages are typically your highest direct expense. If you are not paying market-based wages, your financials bring little value to assist you in making decisions. In fact, incorrect financials will help you make bad decisions based on a false sense of security. There will be times when paying an appropriate wage is impossible. This is when you should create sweat equity, especially if there are multiple owners or investors. Talk to your accountant about accruing wages for financials that are backed out for tax purposes. Paying a market-based wage encourages growth, creates useful financial reports, keeps the IRS at bay, and helps retain employees.

If you have any questions about what a market-based wage looks like for your business, how it works, or for any other questions, reach out to us!

Written by Kerry Weaver, CPA | Published 12/22/2022

Leave a comment