It’s a classic situation: your business is growing just enough to keep everyone busy – maybe too busy – but you’re worried about whether or not to hire a new employee. You may be growing your service agency or other small business for many reasons, so you ask yourself or your accountant, “How much revenue do I need to hire a new employee?” The challenge when hiring is ensuring each new employee generates a healthy profit and return on investment (ROI).

How do I know when it’s time to hire a new employee?

You might be considering growing your team for many reasons. Before you take that step to hire a new employee, confirm that your foundation is already in place to truly succeed with your growth. There are two important key performance indicators (KPIs) that are beneficial when assessing successful growth: Profitability Ratio (%) and Labor Efficiency Ratio (LER).

Start by assessing profitability. Being profitable takes precedence over hiring a new employee, buying a competitor (or their client list), or other growth initiatives. By increasing revenue without profitability, you are just supersizing a sinking ship. It does not matter how much money you bring in if you continue to pay out more in expenses. A good indicator of profitability is your profitability ratio percentage after paying owner-operators a market salary. This percentage refers to the excess of all your income over all your expenses excluding income taxes.

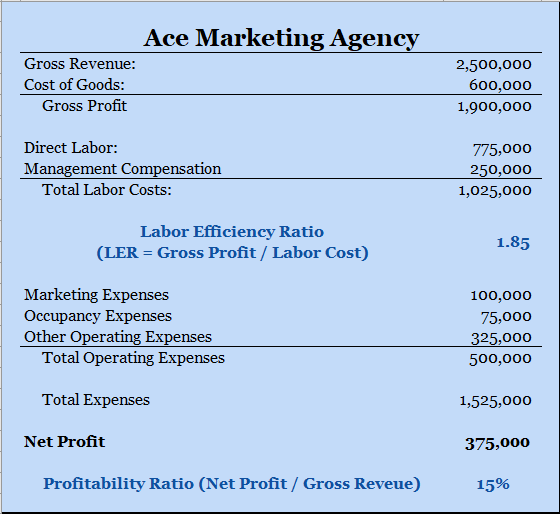

For illustrative purposes, let’s look at Ace Marketing, an agency experiencing growth and ready to hire a new employee. Ace has a strong 15% profitability ratio. This allows room for unexpected dips in the margin without doing overall harm to the business. The goal would be to not drop below 10% as you add employees to ensure you have sufficient working capital through your growth phase.

How to use Profitability and Labor Efficiency Ratios when deciding to hire a new employee

Now that we have a baseline, let’s take a look at how hiring can affect the profitability margins!

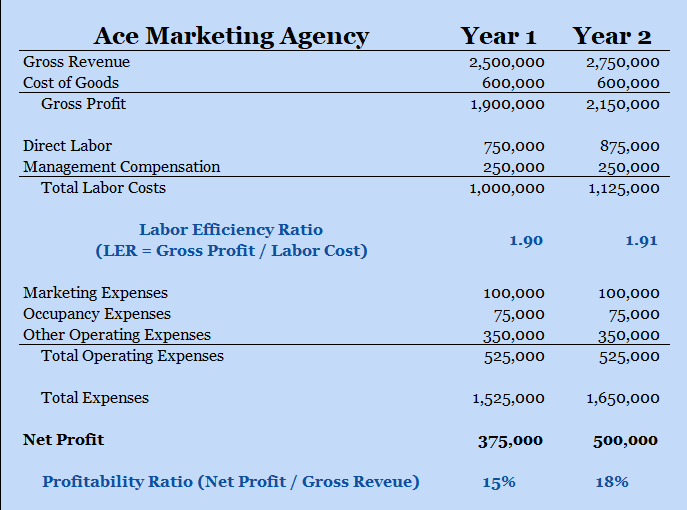

Ace Marketing has decided to hire a new employee in Year 2 without adding any additional business until six months later. This could happen as work shuffles and the new team members get acclimated. Perhaps the shift in work allows for management to concentrate on a new campaign to bring in more business. Ideally, this would be short term and revenue starts to increase to match the additional resources (new employee). By the second half of the year, Ace Marketing expects to increase revenue by 10% or $250,000 from the previous year. Realistically, operating costs will increase from the prior year but to concentrate on the concepts, we’ll keep them constant in our example.

Looking at year 2 as a rolling 12 months, the net profit margin is a strong 18%. After the increase in sales and the recovery of the net profit margin, there is now more cash flow to fund additional growth or payout distributions.

The Labor Efficiency Ratio (LER) included in our example is an indicator of where your labor costs need to be to sustain profitability. The LER measures the amount of gross profit you generate for each dollar spent on labor costs. By knowing your ideal LER, you will know what your labor costs needs to be to sustain profitability.

LER = Gross Profit / Labor Cost

If your business has a gross profit of $2,000,000 and direct labor of $500,000, this is an LER of 4:1. For every dollar spent on labor, four dollars are generated in gross profit. Gross profit is used for this KPI as it the amount of revenue generated by your agency’s labor.

Keeping an eye on your LER is critical. This is a measure of your workforce and their productivity. Since the calculation of LER uses gross profit (revenue – cost of goods sold), labor becomes your biggest expense on your Profit and Loss Statement to evaluate. If you decide that 1.85 is your ideal LER to maintain a 15% profit margin, this is an easy KPI for you to track whether you are deciding to hire a new employee, or any other significant business decision.

The LER can also be a powerful tool to identify which customers or product lines are more profitable. Tracking gross profit and labor by service lines may give you an idea of what areas are best to pursue growth. Perhaps you’ll find out that product branding services equate to an average 2.85 LER. Knowing this, you may focus more efforts on selling this type of service and less on something that calculates to below a 1.85 LER. You may find out that a service you genuinely enjoy providing brings down the overall LER of the company. The challenge now becomes what actions must be taken to increase the average LER of that service line.

The Bottom Line

So, how much revenue does hiring a new employee need to bring in to maintain profit margins? In the example we have been using, Ace has a gross profit margin of 76% which is the measure of revenue left after deducting the costs of goods sold ($1.9m / $2.5m). Ace is increasing wages by $100,000 when they hire a new employee. The new hire needs to increase gross revenue by $243,000 to get back to the 15% profit margin. The calculation is ($100,000 x 1.85 LER) divided by the gross profit margin of 76% = $243,000 in revenue.

Although the answer will be different for everyone reading this article, you are now more likely to succeed if you hire a new employee at the right time and use the right tools to make informed decisions during your growth. Look for an app or software that works with your accounting system so you can easily track the KPIs mentioned here, as well as any others you find are beneficial for your specific business or industry. The more easily you can get to this information, the faster you can identify fluctuations and consider if action is required.

For assistance understanding what these ratios look like for your service agency, or for any other questions, reach out to us!

Written by Kerry Weaver, CPA | Published 10/24/2022

Leave a comment